Advertisement

-

Published Date

January 16, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

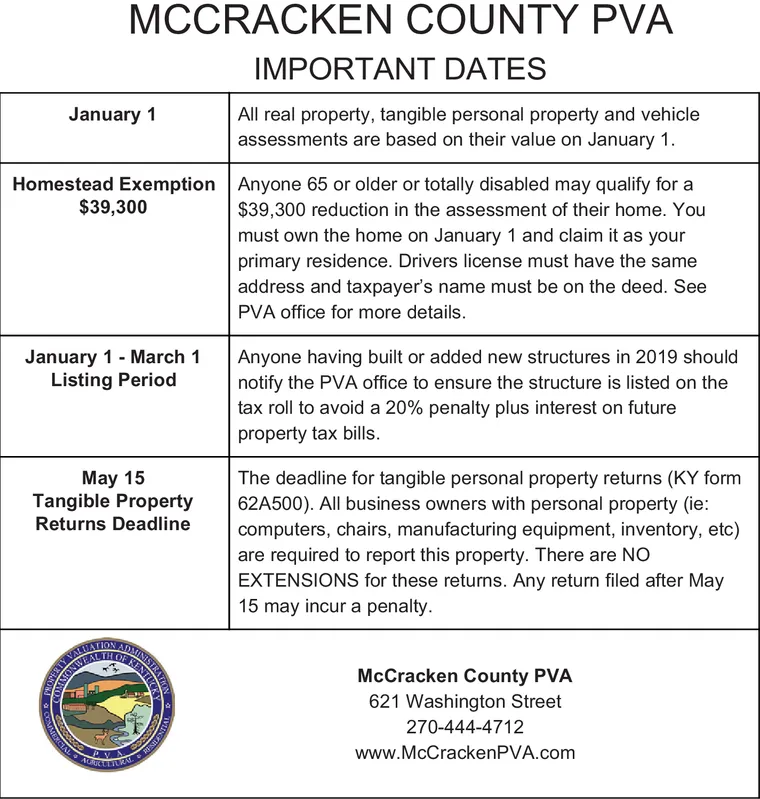

MCCRACKEN COUNTY PVA IMPORTANT DATES January 1 All real property, tangible personal property and vehicle assessments are based on their value on January 1. Homestead Exemption Anyone 65 or older or totally disabled may qualify for a $39,300 $39,300 reduction in the assessment of their home. You must own the home on January 1 and claim it as your primary residence. Drivers license must have the same address and taxpayer's name must be on the deed. See PVA office for more details. January 1 - March 1 Listing Period Anyone having built or added new structures in 2019 should notify the PVA office to ensure the structure is listed on the tax roll to avoid a 20% penalty plus interest on future property tax bills. May 15 Tangible Property The deadline for tangible personal property returns (KY form 62A500). All business owners with personal property (ie: computers, chairs, manufacturing equipment, inventory, etc) are required to report this property. There are NO EXTENSIONS for these returns. Any return filed after May 15 may incur a penalty. Returns Deadline VALA ATION NEAL ADA McCracken County PVA 621 Washington Street 270-444-4712 AG NRAN TVL www.McCrackenPVA.com NTHON VIEN TH NENTUC MCCRACKEN COUNTY PVA IMPORTANT DATES January 1 All real property, tangible personal property and vehicle assessments are based on their value on January 1. Homestead Exemption Anyone 65 or older or totally disabled may qualify for a $39,300 $39,300 reduction in the assessment of their home. You must own the home on January 1 and claim it as your primary residence. Drivers license must have the same address and taxpayer's name must be on the deed. See PVA office for more details. January 1 - March 1 Listing Period Anyone having built or added new structures in 2019 should notify the PVA office to ensure the structure is listed on the tax roll to avoid a 20% penalty plus interest on future property tax bills. May 15 Tangible Property The deadline for tangible personal property returns (KY form 62A500). All business owners with personal property (ie: computers, chairs, manufacturing equipment, inventory, etc) are required to report this property. There are NO EXTENSIONS for these returns. Any return filed after May 15 may incur a penalty. Returns Deadline VALA ATION NEAL ADA McCracken County PVA 621 Washington Street 270-444-4712 AG NRAN TVL www.McCrackenPVA.com NTHON VIEN TH NENTUC