Advertisement

-

Published Date

May 2, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

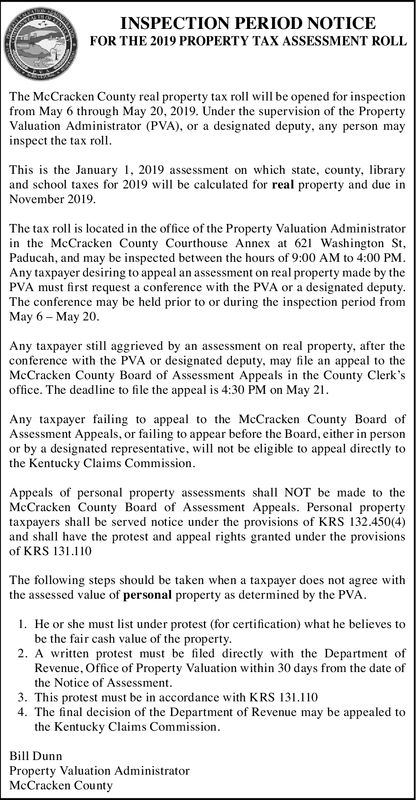

INSPECTION PERIOD NOTICE FOR THE 2019 PROPERTY TAX ASSESSMENT ROLL The McCracken County real property tax roll will be opened for inspection from May 6 through May 20, 2019. Under the supervision of the Property Valuation Administrator (PVA), or a designated deputy, any person may inspect the tax This is the January 1, 2019 assessment on which state, county, library and school taxes for 2019 ill be calculated for real property and due in November 2019 The tax roll is located in the office of the Property Valuation Administrator in the McCracken County Courthouse Annex 621 Washington St Paducah, and may be inspected between the hours of 9:00 AM to 4:00 PM Any taxpayer desiring to appeal an assessment on real property made by the PVA must first request a conference with the PVA or a designated deputy he conference may be held prior to or during the inspection period from May 6- May 20 Any taxpayer still aggrieved by an assessment on real property, after the conference with the PVA or designated deputy, may file an appeal to the McCracken County Board of Assessment Appeals in the County Clerk's office. The deadline to file the appeal is 4:30 PM on May 21 Any taxpayer failing to appeal to the McCracken County Board of Assessment Appeals, or failing to appear before the Board, either in person or by a designated representative, will not be eligible to appeal directly to the Kentucky Claims Commission Appeals of personal property assessments shall NOT be made to the McCracken County Board of Assessment Appeals. Personal property taxpayers shall be served notice under the provisions of KRS 132.4504) and shall have the protest and appeal rights granted under the provisions of KRS 131.110 The following steps should be taken when a taxpayer does not agree with the assessed value of personal property as determined by the PVA I. He or she must list under protest (for certification) what he believes to be the fair cash value of the property 2. A written protest must be filed directly with the Department of Revenue, Office of Property Valuation within 30 days from the date of the Notice of Assessment 3. This protest must be in accordance with KRS 131.110 4. The final decision of the Department of Revenue may be appealed to the Kentucky Claims Commission Bill Dunn Property Valuation Administrator McCracken County INSPECTION PERIOD NOTICE FOR THE 2019 PROPERTY TAX ASSESSMENT ROLL The McCracken County real property tax roll will be opened for inspection from May 6 through May 20, 2019. Under the supervision of the Property Valuation Administrator (PVA), or a designated deputy, any person may inspect the tax This is the January 1, 2019 assessment on which state, county, library and school taxes for 2019 ill be calculated for real property and due in November 2019 The tax roll is located in the office of the Property Valuation Administrator in the McCracken County Courthouse Annex 621 Washington St Paducah, and may be inspected between the hours of 9:00 AM to 4:00 PM Any taxpayer desiring to appeal an assessment on real property made by the PVA must first request a conference with the PVA or a designated deputy he conference may be held prior to or during the inspection period from May 6- May 20 Any taxpayer still aggrieved by an assessment on real property, after the conference with the PVA or designated deputy, may file an appeal to the McCracken County Board of Assessment Appeals in the County Clerk's office. The deadline to file the appeal is 4:30 PM on May 21 Any taxpayer failing to appeal to the McCracken County Board of Assessment Appeals, or failing to appear before the Board, either in person or by a designated representative, will not be eligible to appeal directly to the Kentucky Claims Commission Appeals of personal property assessments shall NOT be made to the McCracken County Board of Assessment Appeals. Personal property taxpayers shall be served notice under the provisions of KRS 132.4504) and shall have the protest and appeal rights granted under the provisions of KRS 131.110 The following steps should be taken when a taxpayer does not agree with the assessed value of personal property as determined by the PVA I. He or she must list under protest (for certification) what he believes to be the fair cash value of the property 2. A written protest must be filed directly with the Department of Revenue, Office of Property Valuation within 30 days from the date of the Notice of Assessment 3. This protest must be in accordance with KRS 131.110 4. The final decision of the Department of Revenue may be appealed to the Kentucky Claims Commission Bill Dunn Property Valuation Administrator McCracken County